Real Estate Stats For Buyers for 2026 In The Phoenix Metro Area

According to the National Association of Realtors, Mortgage Bankers Association, and Fannie Mae, real estate sales are expected to rise in 2026.

In the Phoenix market, we have seen a 3% appreciation in housing over the past few years. They forecast that housing prices will increase by at least 5% between 2026 and 2090, with a potential high of 25.8%, depending on buyer demand. The top reason I hear from buyers for not buying is high interest rates. While the buyer is waiting for lower interest rates, you will end up paying more for the house.

For example, if a house costs $500,000 today with 3.5% down payment and a 6.25% 30-year interest rate, your monthly principal and interest payment would be $3,345.84. In the scenario, assuming just a 3% appreciation over two years, the same house would cost $530,450, with a 3.5% down payment and a reduced interest rate of 5.25%. Your new monthly payment would be $3,201.64, saving you $144.20. However, you must consider the house's higher cost.

Waiting for 2 years would add approximately $ 1,065 to your down payment and $30,450 to the house price, totaling about $31,515 more out of pocket. How much does that two-year delay cost you? Divide $31,515 by your monthly savings of $144.20, and it will take about 218 months ---roughly 18 years---- to break even. While you're waiting, the person who bought two years ago has built up over $49,000 in equity, compared to your $18,565 in equity from your down payment.

Right now is an excellent time to buy, as sellers are willing to pay the buyer's closing costs or buy down the buyer's interest rate. If the market turns towards a seller's market, these concessions will disappear.

Categories

Recent Posts

New Listing Agreement Changes That Can Make Or Break The Sale Of Your Home In Arizona In 2026

How To Stag A Home Without Breaking The Bank

Real Estate Stats For Buyers for 2026 In The Phoenix Metro Area

Top 10% Of Listing Agents in Arizona For Second Quater 2025

6 Strategies to Save on Home Insurance Premiums In Arizona

What is difference between a handyperson and a contractor in Arizona?

7 Mistakes To Avoid When Hiring A Contractor In Arizona

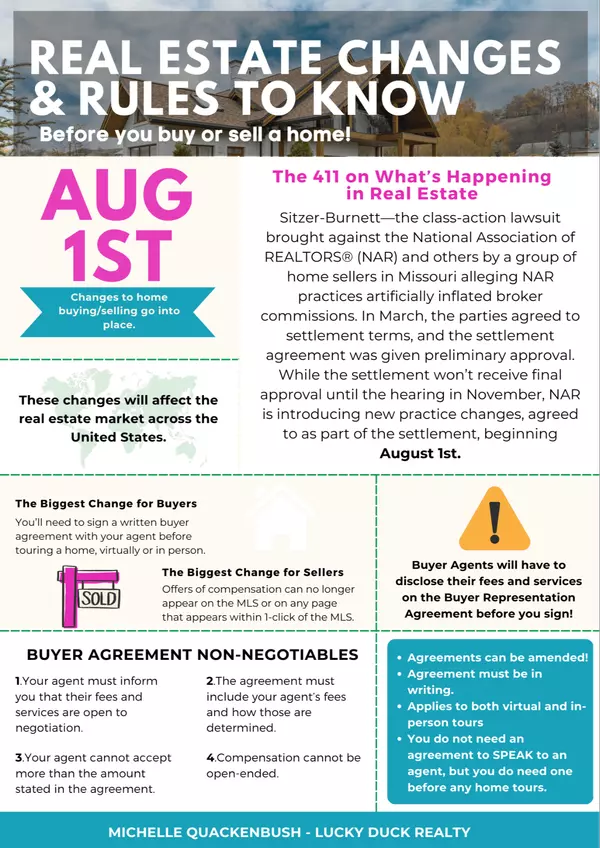

What Changes A Buyer Can Expect When Buying A Home In Arizona

Top 5% of listing agents in Arizona

2023 Best Public Schools In Phoenix Metro Area